The year 2030 marks a pivotal era in finance where cryptocurrencies, once considered on the fringe and associated with speculation, have now become an integral part of the global economy.

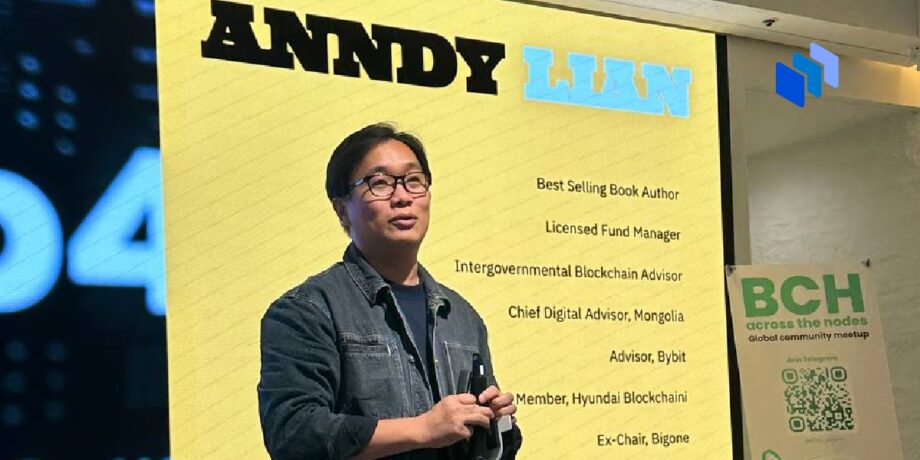

That’s the view of Anndy Lian, who illuminated the factors that propelled this rapid surge in crypto’s acceptance in his enlightening closing speech at the Bitcoin Cash (BCH) Seoul Meetup. As we delve into the future, what obstacles and opportunities are expected to shape the trajectory of the crypto industry and its users?

The Surge in Cryptocurrency Adoption

Blockchain, the pioneering backbone of cryptocurrencies, has revolutionized how transactions are recorded and managed. Its innovative distributed ledger system stands as the linchpin behind the widespread adoption of cryptocurrencies. This groundbreaking technology securely logs transactions in an unchangeable, transparent manner, facilitating direct peer-to-peer exchanges without intermediaries. By bypassing middlemen, blockchain significantly reduces transaction costs and friction, ultimately enhancing efficiency and fostering greater trust among participants.

The evolution of blockchain technology has given rise to a rich array of crypto assets that extend far beyond just Bitcoin (BTC) and Ethereum (ETH). This spectrum includes stablecoins, utility tokens, security tokens, and non-fungible tokens, each designed with distinct functionalities. These assets serve a multitude of purposes, ranging from acting as a secure store of value to enabling seamless exchanges of digital assets, representing tangible real-world assets in a digital format, granting access to decentralized applications (DApps), and enabling ownership of unique digital collectibles.

Forecasts from a comprehensive study conducted by Grand View Research, Inc. paint a compelling picture of the future trajectory of the global cryptocurrency market. The study predicts that by 2030, the market is poised to burgeon to an impressive USD 4,600 billion. This anticipated growth reflects a robust annual expansion rate of 7.1% from 2021 to 2030.

Escalating demands from both retail and institutional investors drive such exponential growth. Additionally, the integration of blockchain technology across a diverse spectrum of industries plays a pivotal role in transforming how businesses operate and transactions are conducted.

Furthermore, the backing of supportive regulations in specific nations contributes significantly to this upward surge, fostering an environment conducive to the flourishing of cryptocurrencies and their associated technologies.

Rising Popularity and Mainstream Embrace

The rise in awareness and understanding among the general populace stands as a pivotal driver behind the soaring popularity of cryptocurrencies. More and more individuals are gaining insights into the potential advantages that cryptocurrencies offer, including their role in fostering financial inclusivity, empowerment, privacy, and autonomy. This increasing knowledge has propelled the uptake of cryptocurrencies.

The availability of diverse platforms and services has played a crucial role in expediting the adoption of cryptocurrencies. These platforms encompass exchanges facilitating crypto trading, wallets for securely storing digital assets, and lending platforms offering innovative financial services within the crypto sphere. Their widespread availability has simplified access for newcomers and seasoned users alike, fueling the growth of cryptocurrency adoption on a global scale.

Forecasts by some analysts, such as Boston Consulting Group (BCG), Bitget, and Foresight Ventures, present an astonishing forecast: surpassing one billion crypto users by 2030. This exponential surge is fueled by a historic growth rate of 63.2% annually.

A multitude of factors contribute to this anticipated surge in crypto users. Notably, the expanding reach and influence of flagship cryptocurrencies like Bitcoin and Ethereum, the emergence of groundbreaking trends like decentralized finance (DeFi) and non-fungible tokens (NFTs), institutional involvement through specialized crypto products, and endorsements by influential personalities collectively drive the mass adoption of cryptocurrencies.

These factors, coupled with the continuous evolution and innovation within the crypto space, are poised to reshape the financial landscape and solidify cryptocurrencies’ position as a mainstream and transformative force in the global economy.

Decentralization: Pillar of Web3

Decentralization serves as the fundamental and revolutionary aspect of cryptocurrencies, defining a system where control isn’t centralized but shared among participants. This concept applies to networks, protocols, or data structures where power and accountability are distributed. It encourages collaboration through consensus mechanisms and economic models that reward cooperative actions.

At the heart of Web3 lies the vision for a next-generation internet constructed upon blockchain and related distributed technologies. Decentralization within Web3 aims to create a more open, fair, and democratic web environment. In this paradigm, users gain increased control and ownership over their data, identity, and digital assets. This shift in power dynamics allows individuals to have a greater say in how their information is used and shared.

Web3’s impact extends beyond mere ownership; it facilitates the development of decentralized applications (DApps), which operate on distributed networks, ensuring greater transparency and security. Smart contracts, encoded within these networks, execute predefined actions autonomously based on predefined conditions, fostering trustless and transparent transactions.

Governance mechanisms within Web3 enable decentralized decision-making processes, allowing stakeholders to actively participate in the management and evolution of the network or platform. Furthermore, the rise of decentralized finance within Web3 has disrupted traditional financial systems, providing innovative and accessible financial services without the need for intermediaries.

Looking ahead, the evolution into Web4 is envisioned, aiming to integrate the physical and digital realms more seamlessly. This next evolution would merge technologies such as artificial intelligence (AI), virtual reality (VR), and the Internet of Things (IoT) into a cohesive ecosystem, further blurring the boundaries between the physical and digital worlds.

The underlying premise of decentralization within Web3 paves the way for a future where users have increased sovereignty over their digital lives, fostering a more transparent, inclusive, and interconnected global landscape.

Challenges and Opportunities Ahead

Despite significant advancements, the landscape of cryptocurrencies faces persistent challenges. The lack of clear regulations across different regions poses substantial risks and obstacles for users, developers, and businesses involved in the crypto space. Additionally, ensuring the robust security and scalability of crypto networks remains a top priority, especially considering the intricate technical intricacies involved.

Addressing these challenges also involves bridging educational gaps and streamlining adoption processes, which are crucial components for realizing the full potential of cryptocurrencies. Simplifying the understanding of cryptocurrencies and their usage can significantly contribute to their widespread acceptance and integration into mainstream use.

Amidst these hurdles, numerous opportunities arise. The collaborative spirit and innovative drive within the crypto community continue to foster groundbreaking advancements and enhance accessibility. This collective creativity holds the potential to empower individuals who are unbanked or marginalized, providing them with access to financial services and opportunities previously unavailable to them.

The transformative impact of cryptocurrencies extends beyond just finance, permeating various industries. Cryptocurrencies have the potential to disrupt traditional models, offering novel solutions that are peer-to-peer and decentralized. These alternatives challenge existing norms, creating avenues for more inclusive, transparent, and equitable systems across different sectors.

The Bottom Line

Cryptocurrency transcends its technical aspects; it symbolizes a movement advocating for transparency, fairness, and democracy. It embodies a cultural shift fostering innovation, collaboration, and diversity. Envisioning a future where everyone has equal access to and benefits from the digital economy is at the core of this vision.

Looking ahead to 2030, one can anticipate crypto’s continued growth, evolution, and the navigation of new challenges and prospects. Its impact will endure, shaping not only the future of currency but also becoming a cornerstone in shaping finance, the web, and the global landscape as a whole.

Source: https://www.techopedia.com/anndy-lian-looking-ahead-to-cryptos-future-in-2030

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.