Sharing additional comments:

I disagree that NFT transaction activity is stabilizing in 2022. I will not say it’s stabilizing, I will use the word “matured”. If you are comparing the “blue chips” of NFTs, yes I do agree that the transaction activities are somewhat dormant. Take Bored Ape for example, if you perhaps hold more than 50 pieces and you want to sell it, can you sell it at the floor price? I do not think so. In another word, the realisation of the sale is not very feasible.

The volume will in fact pick up in the next half of the year given that more NFTs are being made available on more chains. Polygon for instance will be gaining a lot more traction in the months to come with their NFT and game assets NFTs. The in-game assets both in NFT and FT would bring in more liquidity to the space and will help to increase transactions.

You see more variations, music, celebrity, membership, game, even PFPs got more mature and complete storylines. Projects that are trending such as STEPN and Moonbird has inspired many crypto native to come out with a similar concept. Some others such as High Sloth Society is bringing membership to the next level by partnering with Sandbox to replicate a Korean National Treasure onto the Metaverse and showcase Korean heritage in a different way. This brings more utility and usage to NFTs.

Before you can only purchase from Opeansea now there are thousands of marketplaces, centralized and decentralized. Looksrare at one point even overtaken Opensea.

Projects launched this year are also more mature and more “professional”, they have utility, ecosystem, established team (so-called labs), tokenomics (such as X to earn). There are NFT financial products coming out like staking or nesting. This brings in volume.

Adding on, traditional web2 players also came into the picture and try to take a cut from it. We see more and more brands and companies issue their own NFTs or collaborations. This is a win-win for everyone.

This year you can no longer hear a new NFT went up 10,000 times, a 10 times growth will be considered extremely successful. Glad to see the NFT market is now more mature.

———————————————

NFT Activity ‘Stabilizing’ in 2022: Report

- NFT transaction volume growth inconsistent since 2021

- $37 billion poured into NFT marketplaces in 2022 as of May 1

- NFT transaction activity in the week of March 13 lowest since the week of August 1, 2021

- Q1 2022, 950,000 unique addresses bought or sold an NFT, up from 627,000 in Q4 2021

- Web traffic to popular NFT platforms most from Central and Southern Asia

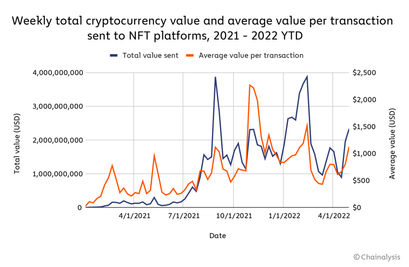

Even as NFT transactions volume grew significantly since the beginning of 2021 despite fluctuating month to month, activities in the space have cooled off in the first quarter of 2022, according to a report from blockchain data firm Chainalysis.

Overall, collectors have sent over $37 billion to NFT marketplaces in 2022 as of May 1, putting them on pace to beat the total of $40bn sent in 2021.

NFT market growth inconsistent

However, since late summer 2021, NFT transaction growth has remained inconsistent, with activity largely remaining flat except for two big spikes: One in late August, which was likely driven by the release of the Mutant Ape Yacht Club collection, and one stretching from late January to early February of 2022, which was likely driven by the launch of the LooksRare NFT marketplace.

After that spike though, NFT transaction activity declined significantly beginning in mid-February, dropping from $3.9bn the week of February 13 to $964 million the week of March 13 — the lowest weekly level since the week of August 1, 2021.

The NFT space is cresting the peak of the Gartner hype cycle and since NFTs are by nature illiquid and communities are built around concepts like diamond hands – who do not sell, many will continue to hold rather than sell for ever-lower prices.

Garrett Minks, CTO of RAIR TECH

“This trend will reverse when real utility is attached to the surviving NFT projects. Blue-chip projects such as Cryptopunks, Bored Apes, and Art Blocks, will likely survive and come out the other side stronger for proving themselves through an entire cycle. Some NFTs might even continue to gain value as safe haven NFTs assets, while liquidity is drained from lower-tier projects,” Minks says.

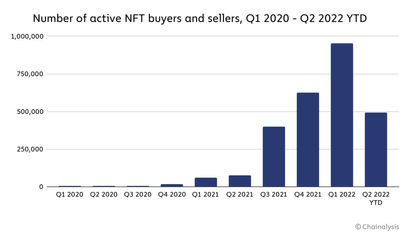

In Q1 2022, 950,000 unique addresses bought or sold an NFT, up from 627,000 in Q4 2021.

Increase in number of active NFT buyers since Q2 2020

Overall, the number of active NFT buyers and sellers has increased every quarter since Q2 2020. In Q2 2022 as of May 1, 491,000 addresses have transacted with NFTs, putting the NFT market on pace to continue its quarterly growth trend in the number of participants, the report states.

Anndy Lian, Thought Leader and Chief Digital Advisor to Mongolian Productivity Organisation disagrees the NFT transaction activity has “stabilized,” but rather “matured”.

“The volume will in fact pick up in the next half of the year given that more NFTs are being made available on more chains. Polygon for instance will be gaining a lot more traction in the months to come with their NFT and game assets NFTs,” he says and adds that this year, one will no longer hear a new NFT went up 10,000 times, a 10 times growth will be considered extremely successful.

Echoing similar sentiments, experts say stabilizing of the NFT activity is a positive sign, that the market is maturing and transitioning from speculation to real application development.

NFT valuation will depend on the usability of the token and the best tokens will be those that allow people to transact real value quickly and simply.

“That may be a virtual good, a service, or something else. The end goal is to have a variety of tokens that people use to buy and sell things as easily as we use dollars today. As long as someone is actively transacting with a token, the value of that token is increasing. The stabilization will happen once a few major applications have been implemented,” Chris Panteli, Founder at LifeUpswing says.

Original Source: https://www.banklesstimes.com/news/2022/05/08/nft-activity-stabilizing-in-2022-report/

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.