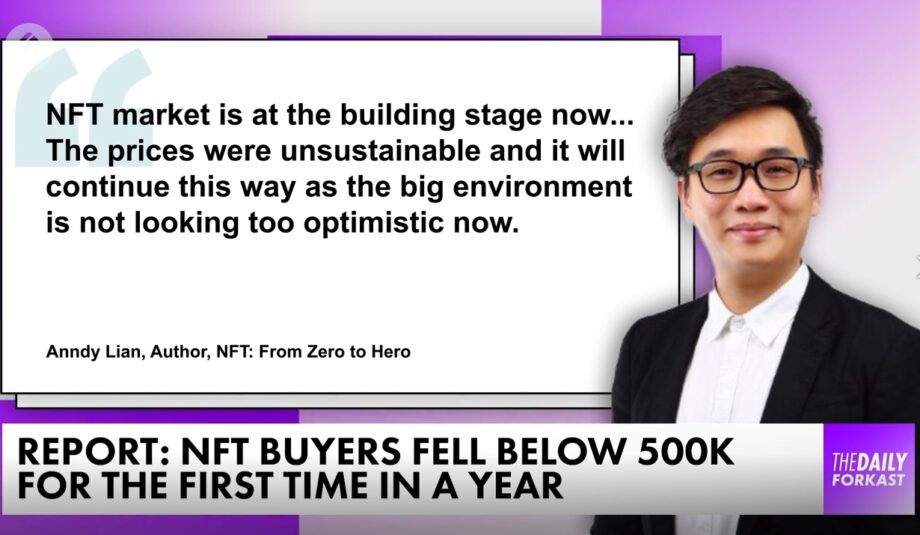

The article did reflect some of my views but also did not. The core message that I was trying to say is that the NFT market is at the rebuilding stage right now. The previous highs that were in the bull market are in a challenging stage. The prices were unsustainable, and it will continue this way as the macro environment is not looking too optimistic now.

There are many contributing factors to this current state but is this the end of the NFT markets? It is not.

Right now there are more projects in the markets working hard behind the scene working on content, books, music, and better gaming assets and experiences. The speculation market has died down, and this is actually very healthy for all of us to grow.

This is a time to go back to basics. We can look at the 5Ps of marketing- Product, Price, Promotion, Place, and People.

When we are in the bull market, whatever products can sell without doing anything. But in the current times, we need to look at the product. Is it value for money?

Pricing is another factor to look at. PFP in the good times can start at a 1 ETH floor price. We should watch our pricing more carefully right now. Take my NFT book, for example, I choose to launch it on Bybit NFT Marketplace at $2.99, not $29.99. This decision was made after looking at the market and the demand from my communities.

Lastly, I think people and community are what we should be building too. If you do not have this, this is the best time to look into it now. This will also help you to get better results when the market turns better.

Anndy Lian

Do I really need another picture of an ape? NFT market slumps in August

The NFT hype from earlier in the year is dying off as the market continues its downward path into the final third of the year. Fire sale coming for apes and cats?

The number of unique non-fungible token (NFT) buyers in August fell below 500,000 for the first time in a year and extended the drop in purchasers to four consecutive months, according to NFT aggregation site CryptoSlam.

Due to an increase in Ethereum prices in early August, total sales rose to US$730 million from July’s US$650 million, but remain a long way short of this year’s January peak of US$4.5 billion.

Yehudah Petscher, NFT relations strategist for CryptoSlam, said the NFT market has caught up with the rest of the world, as traditional markets have been hammered by concerns about rising inflation and interest rates, as well as other global developments.

“People are being much more selective with what they buy and questioning, ‘Do I really want to buy this picture of an ape or a cat for $500?’” Petscher told Forkast in an interview. “You used to give no pause before and you would buy that and you were happy to. And now no, now you need a product. You need something more than just the picture.”

NFTs are regarded as a crucial component of the reimagined

Internet of Web3 — in which gaming, social media and financial services are run through decentralized applications controlled by user’s wallets – so a lagging NFT market could hamper adoption.

The previous high prices in the NFT market were unsustainable, said Anndy Lian, author of the new book “NFT: From Zero to Hero,” in an email response to questions. The “[NFT] environment is not looking too optimistic,” he said, though added that price retrenchments are also when companies build anew.

The Merge

One event on the horizon could further disrupt the NFT market — Ethereum’s Merge planned for later in September.

The Merge will see the world’s second-largest blockchain, which has a market cap of just under US$200 billion and accounted for almost 70% of all NFT transactions in August, move from a proof-of-work (PoW) consensus algorithm to proof-of-stake (PoS).

The buzz around the Merge, saw Ethereum prices almost double in a month to reach as high as US$2,022 in mid-August. Ethereum Classic, the original blockchain from which Ethereum was forked, also more than doubled in the same period to a five-month high of US$45.51.

Both have since fallen back, with Ethereum trading at US$1,587 on Friday in Asia and Ethereum Classic at US$32.67.

“The Merge will cause a short-term price increase in the markets [which] would also help the NFT market in general,” said Lian, adding that the positive impact may stretch for 3-6 weeks. But “I do not think the Merge will start another bull run because the [macro] market conditions do not allow that to happen.”

Petscher said the Merge might “introduce a little chaos” to the market.

As part of the Merge, all NFTs currently hosted on the PoW blockchain must be replicated on the new PoS network to become the “official” versions of the NFTs.

OpenSea, by far the industry’s largest marketplace, announced Thursday that they will only be supporting the PoS versions of NFT collections, but that doesn’t mean a market for the PoW versions won’t emerge, Petscher said.

“The original minted version that was rather historic and birthed this scene — that’s important to me,” said Petscher, “so, I would try to collect that if I could, and I wonder if we’ll see some of those on discount.”

Deja vu?

This situation is not without precedent. A debate emerged earlier this year surrounding the authenticity of CryptoPunks – one of the market’s leading collections with over US$2 billion in sales – as the current collections are actually re-issues designed to fix a bug in the original run, now known as V1 CryptoPunks.

While the CryptoPunks creators, Lava Labs, originally sought to discredit the V1 collection, collectors pushed back and now V1 CryptoPunks are traded in their own right as a piece of NFT history — though with much smaller total sales of US$75 million.

Aside from the Merge, Petscher said it will take a significant catalyst from outside the NFT industry to shake off the current market slump. One example could be Apple Inc. releasing its long-awaited virtual reality (VR) headset, which Petscher says has huge potential for NFT integration.

He also said significant advancements in blockchain protocols are needed to onboard more users to allow the industry to grow as most platforms remain difficult for newcomers to navigate and become fully engaged.

“It’s going to require something big like that,” he said. “Unless, of course, the world changes; if suddenly the war ends and the traditional stock market starts improving, that would lead to the good times again.”

“But I don’t think anybody sees that on the horizon right now.”

Source: https://forkast.news/picture-ape-nft-market-slumps-august/

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.