The Ministry of Industry, Science, Technology and Innovation, in collaboration with the National Productivity Centre of Cambodia (NPCC) and the Asian Productivity Organization (APO), has announced a training course on blockchain technology application in e-government.

The event, being held from August 5-9 in Phnom Penh aims to explore the practical uses of blockchain technology in enhancing e-government systems, with a special highlight on the National Bank of Cambodia’s (NBC) pioneering blockchain initiatives.

Ministry secretary of state and APO director for Cambodia Phork Sovanrith presided over the opening event.

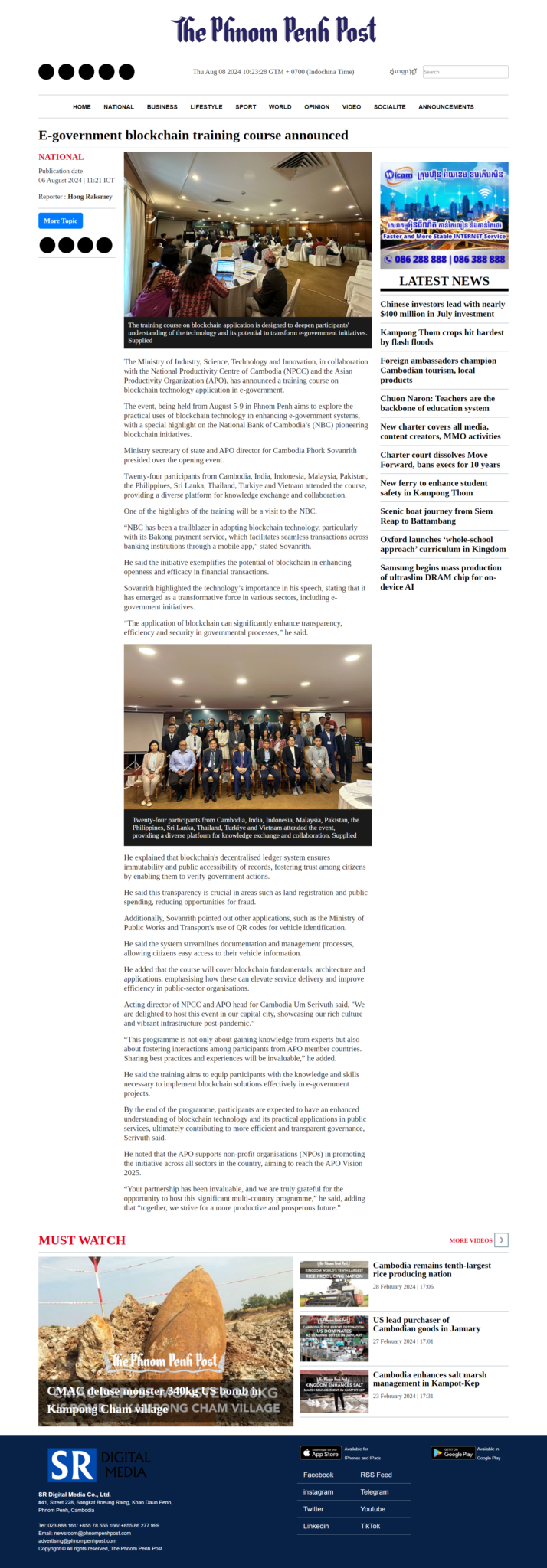

Twenty-four participants from Cambodia, India, Indonesia, Malaysia, Pakistan, the Philippines, Sri Lanka, Thailand, Turkiye and Vietnam attended the course, providing a diverse platform for knowledge exchange and collaboration.

One of the highlights of the training will be a visit to the NBC.

“NBC has been a trailblazer in adopting blockchain technology, particularly with its Bakong payment service, which facilitates seamless transactions across banking institutions through a mobile app,” stated Sovanrith.

He said the initiative exemplifies the potential of blockchain in enhancing openness and efficacy in financial transactions.

Sovanrith highlighted the technology’s importance in his speech, stating that it has emerged as a transformative force in various sectors, including e-government initiatives.

“The application of blockchain can significantly enhance transparency, efficiency and security in governmental processes,” he said.

Twenty-four participants from Cambodia, India, Indonesia, Malaysia, Pakistan, the Philippines, Sri Lanka, Thailand, Turkiye and Vietnam attended the event, providing a diverse platform for knowledge exchange and collaboration. Supplied

He explained that blockchain’s decentralised ledger system ensures immutability and public accessibility of records, fostering trust among citizens by enabling them to verify government actions.

He said this transparency is crucial in areas such as land registration and public spending, reducing opportunities for fraud.

Additionally, Sovanrith pointed out other applications, such as the Ministry of Public Works and Transport’s use of QR codes for vehicle identification.

He said the system streamlines documentation and management processes, allowing citizens easy access to their vehicle information.

He added that the course will cover blockchain fundamentals, architecture and applications, emphasising how these can elevate service delivery and improve efficiency in public-sector organisations.

Acting director of NPCC and APO head for Cambodia Um Serivuth said, “We are delighted to host this event in our capital city, showcasing our rich culture and vibrant infrastructure post-pandemic.”

“This programme is not only about gaining knowledge from experts but also about fostering interactions among participants from APO member countries. Sharing best practices and experiences will be invaluable,” he added.

He said the training aims to equip participants with the knowledge and skills necessary to implement blockchain solutions effectively in e-government projects.

By the end of the programme, participants are expected to have an enhanced understanding of blockchain technology and its practical applications in public services, ultimately contributing to more efficient and transparent governance, Serivuth said.

He noted that the APO supports non-profit organisations (NPOs) in promoting the initiative across all sectors in the country, aiming to reach the APO Vision 2025.

“Your partnership has been invaluable, and we are truly grateful for the opportunity to host this significant multi-country programme,” he said, adding that “together, we strive for a more productive and prosperous future.”

Source: https://www.phnompenhpost.com/national/e-government-blockchain-training-course-announced

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.