The cryptocurrency market boomed in 2021, enjoying a surge in mainstream popularity and acceptance, as well as finding favour with governments and financial institutions seeking to explore a world of payments and transactions beyond the traditional banking paradigm.

Some have gone as far as to label 2021 as the breakthrough year for cryptocurrency. Bitcoin (BTC) hit multiple new all-time high prices; we saw more widespread institutional crypto adoption from major companies; and higher levels of regulation and enforcement were introduced that have the potential to transform the industry as a whole.

There’s certainly a compelling case to be made that cryptocurrency has proven itself as a growing sector. CoinMarketCap data currently lists over 13,000 cryptocurrencies in existence, while the total market capitalisation of all crypto assets surpassed $2tn for the first time in September this year, a tenfold increase since early 2020.

The mere fact that a critical mass of credible institutions are now engaging with crypto assets means cryptos have cemented their position as an official asset class. A clear indication of this is Square investing $50m and $170m in bitcoin (BTC) in the first quarter of 2020 and the first quarter of 2021, respectively.

Tesla announced in its 2020 annual report filing submitted to the US Securities and Exchange Commission (SEC) that it had invested $1.5bn in BTC, while PayPal announced in October 2020 that it is launching a new service enabling customers to buy, hold and sell cryptocurrency directly from their PayPal account.

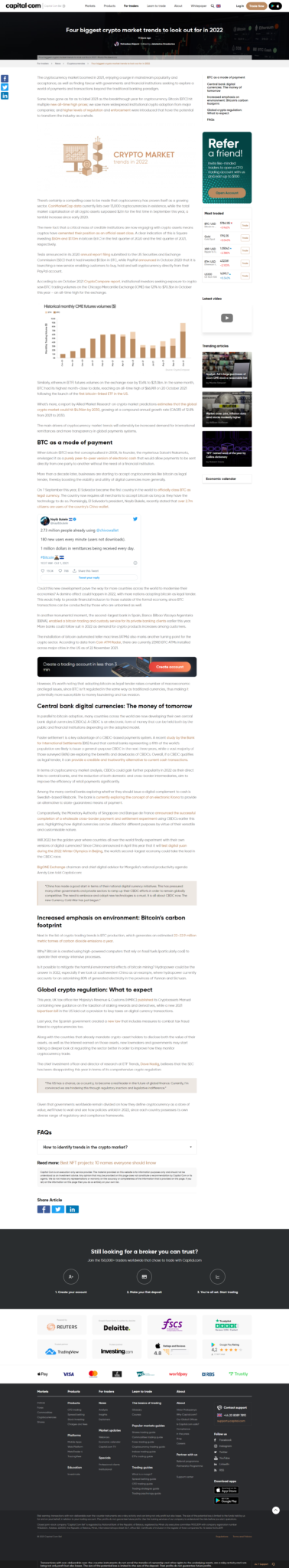

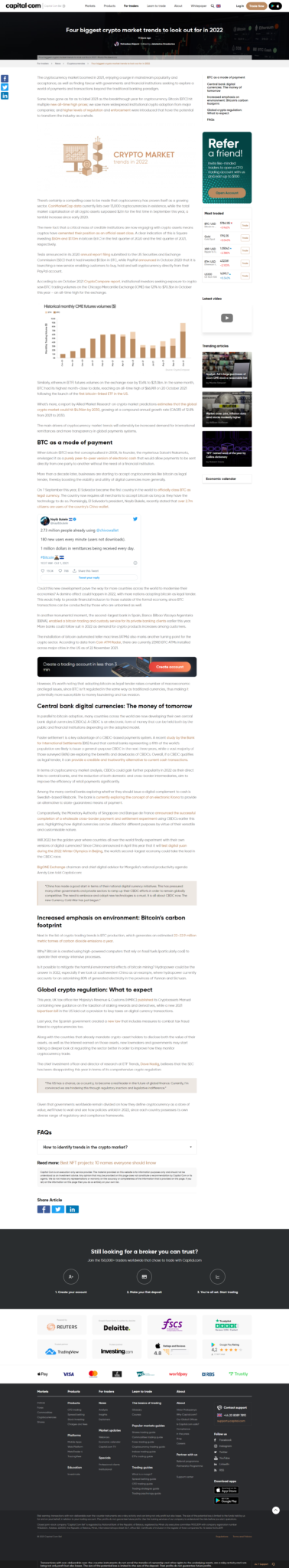

According to an October 2021 CryptoCompare report, institutional investors seeking exposure to crypto saw BTC trading volumes on the Chicago Mercantile Exchange (CME) rise 121% to $70.3bn in October this year – an all-time high for the exchange.

Similarly, ethereum (ETF) futures volumes on the exchange rose by 13.6% to $21.0bn. In the same month, BTC had its highest month-close to date, reaching an all-time high of $66,981 on 20 October 2021 following the launch of the first bitcoin-linked ETF in the US.

What’s more, a report by Allied Market Research on crypto market predictions estimates that the global crypto market could hit $4.94bn by 2030, growing at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2030.

The main drivers of cryptocurrency market trends will ostensibly be increased demand for international remittances and more transparency in global payments systems.

BTC as a mode of payment

When bitcoin (BTC) was first conceptualised in 2008, its founder, the mysterious Satoshi Nakamoto, envisaged it as a purely peer-to-peer version of electronic cash that would allow payments to be sent directly from one party to another without the need of a financial institution.

More than a decade later, businesses are starting to accept cryptocurrencies like bitcoin as legal tender, thereby boosting the viability and utility of digital currencies more generally.

On 7 September this year, El Salvador became the first country in the world to officially class BTC as legal currency. The country now requires all merchants to accept bitcoin as long as they have the technology to do so. Promisingly, El Salvador’s president, Nayib Bukele, recently stated that over 2.7m citizens are users of the country’s Chivo wallet.

Could this new development pave the way for more countries across the world to modernise their economies? A domino effect could happen in 2022, with more nations adopting bitcoin as legal tender. This would help to provide financial inclusion to those outside of the formal economy, since BTC transactions can be conducted by those who are unbanked as well.

In another monumental moment, the second-largest bank in Spain, Banco Bilbao Vizcaya Argentaria (BBVA), enabled a bitcoin trading and custody service for its private banking clients earlier this year. More banks could follow suit in 2022 as demand for crypto products increases among customers.

The installation of bitcoin automated teller machines (ATMs) also marks another turning point for the crypto sector. According to data from Coin ATM Radar, there are currently 27,983 BTC ATMs installed across major cities in the US as of 22 November 2021.

However, it’s worth noting that adopting bitcoin as legal tender raises a number of macroeconomic and legal issues, since BTC isn’t regulated in the same way as traditional currencies, thus making it potentially more susceptible to money laundering and tax evasion.

Central bank digital currencies: The money of tomorrow

In parallel to bitcoin adoption, many countries across the world are now developing their own central bank digital currencies (CBDCs). A CBDC is an electronic form of money that can be held both by the public and financial institutions depending on the adopted model.

Faster settlement is a key advantage of a CBDC-based payments system. A recent study by the Bank for International Settlements (BIS) found that central banks representing a fifth of the world’s population are likely to issue a general-purpose CBDC in the next three years, while a vast majority of those surveyed (86%) are exploring the benefits and drawbacks of CBDCs. Overall, if a CBDC qualifies as legal tender, it can provide a credible and trustworthy alternative to current cash transactions.

In terms of cryptocurrency market analysis, CBDCs could gain further popularity in 2022 as their direct links to central banks, and the reduction of both domestic and cross-border intermediaries, aim to improve the efficiency of retail payments significantly.

Among the many central banks exploring whether they should issue a digital complement to cash is Swedish-based Riksbank. The bank is currently exploring the concept of an electronic Krona to provide an alternative to state-guaranteed means of payment.

Comparatively, the Monetary Authority of Singapore and Banque de France announced the successful completion of a wholesale cross-border payment and settlement experiment using CBDCs earlier this year, highlighting how digital currencies can be utilised for different purposes by virtue of their versatile and customisable nature.

Will 2022 be the golden year where countries all over the world finally experiment with their own versions of digital currencies? Since China announced in April this year that it will test digital yuan during the 2022 Winter Olympics in Beijing, the world’s second-largest economy could take the lead in the CBDC race.

BigONE Exchange chairman and chief digital advisor for Mongolia’s national productivity agenda Anndy Lian told Capital.com:

“China has made a good start in terms of their national digital currency initiatives. This has pressured many other governments and private sectors to ramp up their CBDC efforts in order to remain globally competitive. The need to embrace and adopt new technologies is a must. It is all about CBDC now. The new Currency Cold War has just begun.”

Increased emphasis on environment: Bitcoin’s carbon footprint

Next in the list of crypto trading trends is BTC production, which generates an estimated 22–22.9 million metric tonnes of carbon dioxide emissions a year.

Why? Bitcoin is created using high-powered computers that rely on fossil fuels (particularly coal) to operate their energy-intensive processes.

Is it possible to mitigate the harmful environmental effects of bitcoin mining? Hydropower could be the answer in 2022, especially if we look at southwestern China as an example, where hydropower currently accounts for an astonishing 80% of generated electricity in the provinces of Yunnan and Sichuan.

Global crypto regulation: What to expect

This year, UK tax office Her Majesty’s Revenue & Customs (HMRC) published its Cryptoassets Manual containing new guidance on the taxation of staking rewards and derivatives, while a new 2021 bipartisan bill in the US laid out a provision to levy taxes on digital currency transactions.

Last year, the Spanish government created a new law that includes measures to combat tax fraud linked to cryptocurrencies too.

Along with the countries that already mandate crypto-asset holders to disclose both the value of their assets, as well as the interest earned on those assets, new lawmakers and governments may start taking a deeper look at regulating the sector better in order to improve how they monitor cryptocurrency trade.

The chief investment officer and director of research at ETF Trends, Dave Nadig, believes that the SEC has been disappointing this year in terms of its comprehensive crypto regulation:

“The US has a chance, as a country, to become a real leader in the future of global finance. Currently, I’m convinced we are hindering this through regulatory inaction and legislative indifference.”

Given that governments worldwide remain divided on how they define cryptocurrency as a store of value, we’ll have to wait and see how policies unfold in 2022, since each country possesses its own diverse range of regulatory and compliance frameworks.

Original Source: https://capital.com/crypto-market-trends-what-is-next

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.