As the year draws to a close, it’s time to reflect on the Web3 predictions made at the dawn of 2023. Visionaries and experts from across the industry shared their insights on where the world of blockchain, NFTs, and decentralized technologies was heading. But did reality meet expectations? Let’s delve into the five key predictions and measure them against the outcomes.

1. Tokenization of Real-World Assets

Prediction:

Experts foresaw a significant shift with the tokenization of tangible assets like real estate, driven by the unique capabilities of tokens and smart contracts. “One of the big innovations of Web3 are tokens — both fungible and non-fungible assets that are inherently unique — and the ability to program them with smart contracts that track them,” said Avivah Litan, vice president and analyst at Gartner.

What Actually Happened:

The tokenization of real-world assets (RWAs) has indeed taken significant strides in 2023. Boston Consulting Group projects that by the end of the decade, the tokenization of global illiquid assets could be a colossal US$16 trillion industry. The total value of tokenized RWAs reached a record US$2.75 billion in August 2023, indicating robust market growth. Institutions have shown a marked interest in tokenized assets, with 91% of institutional investors considering investments in them. Real estate, in particular, has seen explosive growth with the value of on-chain real estate surging by 102% in just three quarters.

Projects like RealT and Tangible have dominated the market, with the latter growing the total market cap of its token from US$100,000 to an impressive US$95.6 million as of November 9, 2023. Beyond real estate, tokenization is making inroads into collectibles, luxury goods, and traditional financial instruments like bonds and ETFs. Even U.S. Treasurys have been tokenized, reaching a valuation of US$698 million. Banking giants UBS and JPMorgan have also entered the fray, launching platforms to bridge traditional financial assets with blockchain technology.

2. Web 3.0 Browsers: Empowering Users

Prediction:

Web 3.0 promised browsers that would return data control to the users, fostering trust and ownership, was a big prediction this year. The prediction suggested a pivotal change in how customer relationships are managed online.

What Actually Happened:

The landscape of web browsing has taken a significant turn with the adoption of Web 3.0 browsers, which emphasize user privacy, security, and decentralization. Throughout 2023, browsers like Brave, Opera, and Osiris have led the charge in integrating blockchain technologies, offering built-in crypto wallets, and providing direct access to decentralized applications (dApps). Brave, for instance, has seen a surge in users, boasting over 50 million monthly active users. These browsers have not only delivered enhanced privacy through anonymous browsing and ad-blocking features but have also incentivized users with cryptocurrency rewards.

The year saw a proliferation of such browsers, each introducing unique functionalities aimed at a decentralized web experience, ranging from Puma’s peer-to-peer file hosting to Beaker’s ability to create and host websites without servers. The developments in Web 3.0 browsers indicate a move towards a more secure, user-controlled internet, fulfilling the predictions made at the beginning of the year.

3. Accessible Blockchain via BaaS

Prediction:

Many, including Sani Abdul-Jabbar, a Forbes Councils Member, believed that in 2023, blockchain-as-a-service (BaaS) would be a game-changer for businesses, offering an easy and cost-effective way to adopt blockchain technology without the need for in-house development. This shift will enable companies to enhance operations and competitiveness in their markets.

What Actually Happened:

The blockchain-as-a-service (BaaS) market has experienced a meteoric rise, witnessing considerable growth throughout 2023 and projected to expand significantly until 2030. The surge is mainly attributed to the escalating demand across diverse sectors such as banking, financial services, insurance, information technology and telecom services, healthcare, retail, and government, among others. Notably, North America, and particularly the United States, played a pivotal role in this growth, leveraging advanced technology and housing major industry players. Europe also contributed to the market’s expansion with a significant CAGR. Leaders in the BaaS landscape, like Infosys, IBM, Accenture, AWS, and Microsoft, have driven innovation and adoption, with the market’s value anticipated to reach new heights by the end of the decade.

The increasing need for cost-effective and efficient blockchain solutions has bolstered the demand for BaaS, with a clear post-COVID-19 recovery trend and optimistic investment forecasts for the future. The sector’s growth trajectory is underpinned by technological advances, enhancing product performance and downstream applications. The BaaS market’s upward trend reflects a growing appreciation for blockchain’s transformative potential in mainstream business applications.

4. AI Integration in Web3 and NFTs

Prediction:

In 2023, AI was predicted to significantly influence NFTs, with creators using it to craft narratives through graphic novels, films, and interactive games that incorporate NFTs. This integration will allow for rapid world-building and asset creation, transforming the pace and scope of project development in the Web3 space. Anjali Young, co-founder of Collab.Land and chief community officer of Abridged, highlighted the profound impact AI will have on NFT innovation and engagement this year.

What Actually Happened:

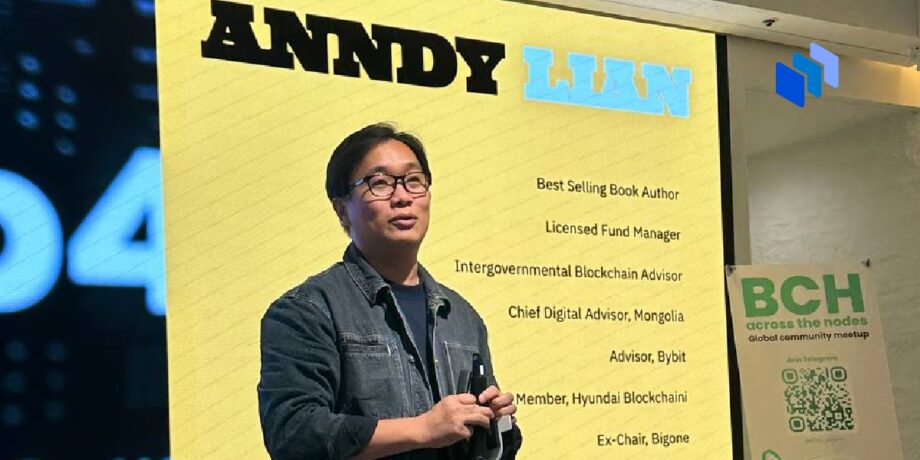

In 2023, the NFT space was indeed significantly influenced by the integration of Web3 and AI, as highlighted by Anndy Lian in his keynote speech at the NFT 2023 Seoul conference. NFTs, which are unique digital assets verifiable via blockchain, have seen exponential market growth, with major collections fetching millions at auctions and sales volumes hitting staggering figures. AI has been pivotal in advancing NFTs, enabling the automatic generation of digital art and creating interactive, intelligent NFTs that can speak and learn. Web3’s decentralized, user-centric internet model further supports the NFT ecosystem by providing secure and efficient identity management and proof of ownership, enhancing user participation and control.

The union of AI and Web3 with NFTs is driving a new era of digital asset innovation and ownership, offering a democratized and decentralized internet experience. This fusion promises a future where digital assets are dynamic, intelligent, and integral to user interactions within the digital environment.

5. Democratization of NFT Creation

Prediction:

In 2023, the arrival of an open-source platform akin to “WordPress for Web3” is anticipated to revolutionize the creation and launch of NFT projects, removing current barriers and simplifying the process without the need for specialized developers or consultants. This innovation will pave the way for mass adoption and versatility in NFT use cases, supported by an open architecture that allows for extensive customization through third-party tools. Michael Stelzner, founder and CEO of Social Media Examiner, host of the Web3 Business Podcast, and author of the books Writing White Papers and Launch, predicts this pivotal development will catalyze a new era of creativity and entrepreneurship in Web3, laying the groundwork for its future expansion.

What Actually Happened:

OpenSea, the leading NFT marketplace, introduced OpenSea Studio in 2023, revolutionizing the process of NFT creation and making it a more inclusive and accessible activity. The platform democratized the creation of NFTs by providing a user-friendly interface that requires no coding skills, allowing creators to mint NFTs directly into their wallets with ease. With the inclusion of features such as blockchain compatibility and payment options via credit or debit cards, OpenSea Studio has lowered the barriers for entry into the NFT space, aligning with the efforts of platforms like Manifold and ThirdWeb.

This shift towards greater democratization has had a substantial impact on the NFT community, encouraging wider participation and innovation in digital art and asset creation. The move also signifies the end of OpenSea’s lazy-minting feature, paving the way for creators to establish collections on independent smart contracts, offering more control and customization over their digital assets. OpenSea Studio’s introduction is a testament to the evolving NFT landscape, focusing on creator empowerment and expanded access.

As we wrap up our comprehensive review of Web3’s trajectory in 2023, it’s clear that the year has been a watershed moment for blockchain technology, NFTs, and decentralized platforms. The advancements we’ve witnessed have not only met but in many cases, exceeded the ambitious predictions set forth at the year’s outset. From the burgeoning tokenization of real-world assets to the empowering shift in web browsing experiences, the strides made towards accessible blockchain services, and the exciting fusion of AI with NFTs, 2023 has been a year of significant milestones.

Embracing Web3’s Leap Forward

Reflecting on 2023, Web3 has surpassed expectations, marking a year of unprecedented growth and innovation. The tangible impact of tokenization, user-centric web browsing, the rise of blockchain services, and the synergy between AI and NFTs underscore a pivotal shift. With each stride, Web3 cements itself as a transformative force. Keep an eye on BTSE’s blog for future insights into this ever-evolving digital landscape.

Source: https://www.btse.com/blog/web3-in-review-a-reality-check-on-2023s-top-five-predictions/

How has AI integration influenced the NFT space within Web3?

In 2023, the integration of AI into Web3 significantly impacted the NFT space, revolutionizing asset creation and project development. Key figures like Anjali Young and Anndy Lian highlighted AI's role in crafting narratives, generating digital art, and creating interactive, intelligent NFTs. This integration accelerated market growth, with NFT collections fetching millions and sales volumes reaching unprecedented levels. Discover the profound influence of AI on NFT innovation within Web3.

What role does AI play in advancing NFTs and shaping the Web3 ecosystem?

In the context of NFTs, AI has been pivotal in automating digital art generation and enabling the creation of interactive, intelligent NFTs capable of learning and communicating. Anndy Lian, speaking at the NFT 2023 Seoul conference, emphasized AI's impact in empowering the NFT market's exponential growth. Explore how AI integration is reshaping the Web3 landscape, enhancing user engagement, and fostering a democratized digital asset ownership experience.

How does the fusion of AI, Web3, and NFTs drive innovation in digital asset ownership?

The convergence of AI and Web3 technologies has propelled the NFT space into a new era of innovation and ownership. This fusion not only facilitates the automatic generation of digital assets but also secures and verifies ownership via blockchain. Learn how this union revolutionizes the digital landscape, promising a future where dynamic and intelligent digital assets redefine user interactions and participation in the decentralized internet environment.

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.