The initial article was published at Nikkei Asia and was republished on sites such as DealStreet and K. I hope to add more context to my comments.

Q1/ Singapore is warning investors about investing in cryptocurrencies while selectively giving licenses for crypto/digital asset platforms to operate. How contradictory is this approach and what are authorities exactly trying to achieve here?

Singapore’s approach is essentially one guided by the traditional finance structure, applying existing legal frameworks where possible, to protect the investing public. As a result, the regulators are proactive about warning individual investors about the risks in investing in cryptocurrencies, which is what you would expect.

But I do think Singapore’s approach is also very contradictory. I do not agree with the practice of selectively granting licences to different crypto entities. The whole process of selecting who to give the licence to is not very transparent in my opinion.

If you look at the licences that have been given out so far, to the brokerage arm of Southeast Asia’s largest lender DBS Bank, and Australian cryptocurrency exchange Independent Reserve, it gives the impression that the government is favouring big players and foreign exchanges.

Right now, a lot of crypto exchanges and startups who regard Singapore still as a crypto hub, are doing their very best to stay in Singapore and be licensed. But the truth of the matter is that most of them are effectively in regulatory limbo. They have no idea what exactly is going to happen next, whether or not their application will be approved.

What I would like to see is for the regulator, the Monetary Authority of Singapore (MAS), to take a more systematic and open-handed approach to licensing, so that every crypto business will have an equal opportunity to comply with its requirements.

Q2. What are the positive aspects and drawbacks of the way Singapore is approaching the regulation of crypto and digital asset activities?

The positive aspect is that Singapore is trying to build its own crypto ecosystem by embracing crypto exchanges and startups, and I think that is positive.

The drawback in the current approach, and one that I really do not want to see, is for all intent and purposes an elitist model where only businesses that appear to be in favour with the regulator are able to get a licence in a reasonable time span.

Singapore is obviously trying to both embrace crypto, and at the same time also trying to regulate the crypto sector to protect investors and the public at large. But it’s a difficult balance to strike, and without an impartial and transparent approach to licensing, they risk defeating the purpose of making cryptocurrencies available to all.

Between crypto and traditional assets there are key differences, not least of which is their decentralized nature. As a result, whatever applied in the past to traditional assets might not work so well for cryptocurrency, because of the way it works and how people use it.

It comes down to the fact that Singapore needs to find new ways to regulate this dynamic new sector, without trying to rely on existing models that are no longer fit for purpose, if it’s to be a leading hub for cryptocurrencies in Southeast Asia and globally.

Q3. Which countries in Southeast Asia and the rest of Asian can perhaps best be able to emulate Singapore’s regulatory approach and why?

I believe South Korea and Hong Kong, with similar financial systems, can best emulate the whole regulatory approach, and by learning the lessons so far do it a lot better than Singapore. That said, the recent announcement by China banning crypto activities leaves the fight for the top spot for crypto in Southeast Asia up for grabs. As well as South Korea and Hong Kong, I also see Japan as a big threat to Singapore in the fight to be Asia’s crypto

_______________________________________________

Crypto entrepreneurs find Singapore is not so hospitable after all

Cryptocurrency entrepreneurs lured to Singapore by its apparent openness to the burgeoning industry are discovering just how difficult it is to legally operate in the city-state.

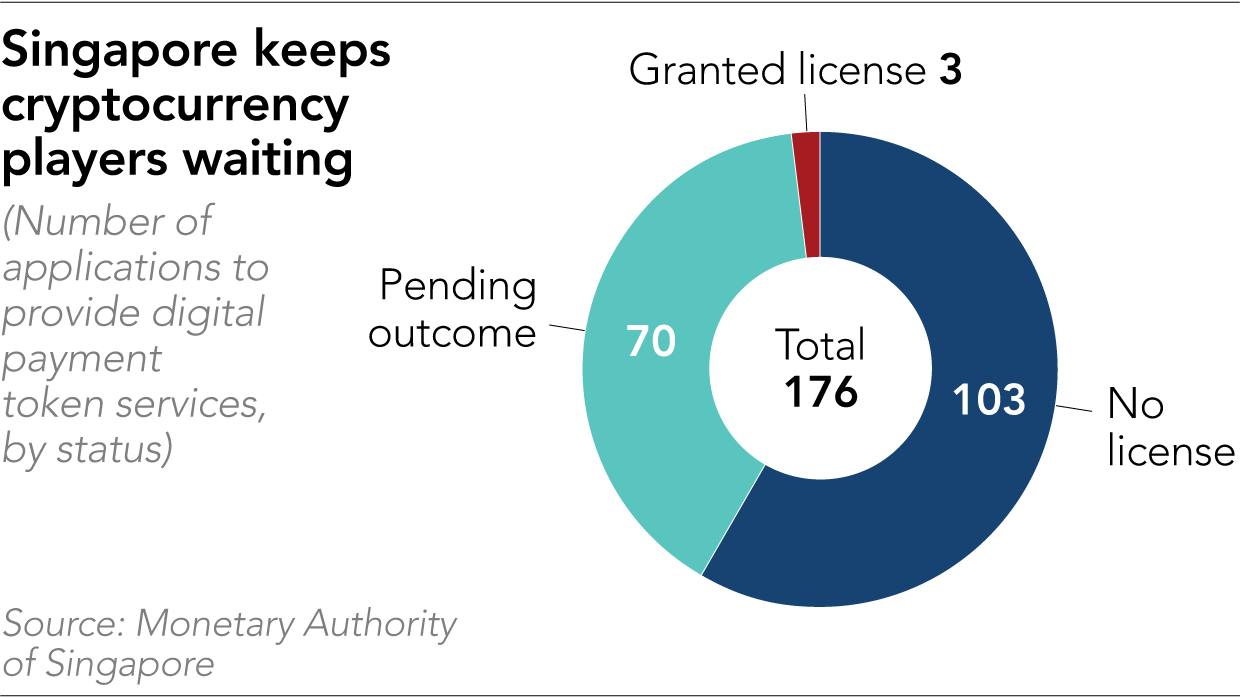

More than 100 of the around 170 businesses that applied for licenses to offer “digital payment token services” have now been turned down or withdrawn their applications, according to the latest figures from regulators.

And scores more face an uncertain future, operating under exemptions but amid a darkening mood over the approval process.

In early September, the Monetary Authority of Singapore (MAS) ordered Binance, one of the world’s largest crypto exchanges, to stop providing services to residents in the city-state, and last week Binance’s Singapore-only affiliate announced it also was shutting down its trading platform for the city-state. Dozens are confronting a similar fate.

Dubai-based crypto exchange Bitxmi is one of 103 companies that appear on the latest MAS list of entities whose exemptions allowing them to operate have been removed. Having set up in Singapore in late 2018, it was unsuccessful in securing a license, chief executive officer Sanjay Jain told Nikkei Asia.

“We can’t operate in Singapore,” he said. “We have an office there, but it’s just more or less—there’s one person for our accounting and legal issues.”

Jain declined to speak about why his outfit did not manage to secure a license from regulators. “That, you need to ask them,” he said.

The introduction of the licensing regime in January was cast as the next step in building a thriving crypto sector and set up a contrast with Singapore’s rival Asian financial hub, Hong Kong, which had taken a more skeptical approach to crypto businesses.

A spokesperson for MAS told Nikkei that it is supportive of innovation in the use of blockchain technology, which underpins cryptocurrencies, while also recognizing the risks.

“Cryptocurrencies could be abused for money laundering, terrorism financing, or proliferation financing due to the speed and cross-border nature of the transactions,” the spokesperson said. “Digital payment token service providers in Singapore … have to comply with requirements to mitigate such risks, including the need to carry out proper customer due diligence, conduct regular account reviews, and monitor and report suspicious transactions.”

Rahul Advani, Asia-Pacific policy director at blockchain company Ripple, said Singapore’s stance on digital assets has resulted in the city-state being one of the most advanced and mature nations in the field, helping foster development and innovation in the emerging industry.

“It’s very clear where digital assets and related activities lie on the risk spectrum, so you mitigate the potential of developing and investing in technology that is unregulated,” he told Nikkei.

Crypto players that raced to set up in Singapore run the spectrum from exchange platforms for trading bitcoin, Ethereum, and other tokens, through investment managers and financial advisers looking after digital asset portfolios for the wealthy, to business-to-business outfits helping corporate clients accept cryptocurrency payments.

Outfits that were operating in the country prior to the introduction of the licensing regime were granted exemptions until the outcome of their license application is known. Senior Minister Tharman Shanmugaratnam told parliament in July that there were 90 companies operating under such exemptions.

The MAS website showed that the group had shrunk to about 70 as of December 14.

So far, only three players—DBS Vickers Securities, a unit of Singapore and Southeast Asia’s largest bank, DBS Group Holdings; digital payments startup FOMO Pay; and Australia’s Independent Reserve, which offers crypto exchange services—have been listed on the MAS website as licensed entities.

Two others—Coinhako, which operates a crypto exchange platform, and TripleA, a payments company—have put out announcements themselves saying they have acquired the necessary approvals to operate.

Anndy Lian, chairman of Netherlands-registered crypto trading platform BigONE Exchange, told Nikkei that his outfit does not intend to apply for a license in Singapore presently.

“The whole process of selecting who to give the license to is not very transparent,” he said. “It gives the impression that the government is favoring big players and foreign exchanges.”

MAS has not publicly disclosed why specific crypto players were unable to obtain a permit.

But Nikkei understands that some of them did not have the capacity or infrastructure to meet the high compliance standards set out by the financial regulator to deter money laundering and financing of terrorism.

“Cryptocurrencies are currently being used to channel the earnings of everything from ransomware proceeds, the sale of narcotics to some of the most horrific crimes, including human trafficking,” said Rachel Woolley, head of financial crime at client management solutions provider Fenergo.

“Regulators have now entered this space in an effort to protect the financial services industry from illicit activity in much the same way that activity involving fiat currency must be monitored.”

MAS pointed to comments from its managing director, Ravi Menon, who has said that Singapore does not need 160 players in the crypto sector and it may be better to have “half of them” operating at very high standards.

TripleA told Nikkei that in securing its permit, it had to ensure that its operating procedures for risk assessment, customer due diligence, record-keeping, suspicious transaction reporting, auditing, and training were up to snuff.

But its CEO, Eric Barbier, said TripleA gained little insight into what exactly made the difference between success and failure.

“MAS never talks. MAS asks questions and questions and questions,” he said. “You can ask questions but they will not answer, and most regulators are like this.”

Barbier reckoned that being a business serving other businesses may have helped secure a license. “Especially for consumer-to-consumer, like consumer exchanges and so on, the risk of money laundering is very high, so they need to demonstrate to MAS that they are able to mitigate all those risks accordingly,” he said.

Peiying Chua, financial regulation partner for Singapore at the law firm Linklaters, said it is unlikely MAS is specifically favoring big, incumbent financial players: “Likely reasons for unsuccessful applicants may include a lack of track record or key personnel without adequate experience, a lack of a sustainable business model or serious adverse records relating to directors and key individuals.”

“The regulatory approach by MAS may to some degree stifle innovation in smaller entrepreneurs and sift out smaller virtual asset service providers that may not be able to comply with the regulations,” said Quek Li Fei, partner at law firm CNPLaw.

But he added it “provides a more forward-thinking approach toward encouraging legitimate innovation and entrepreneurship in cryptocurrency and digital asset businesses, with a reasonable level of protection to investors.”

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.