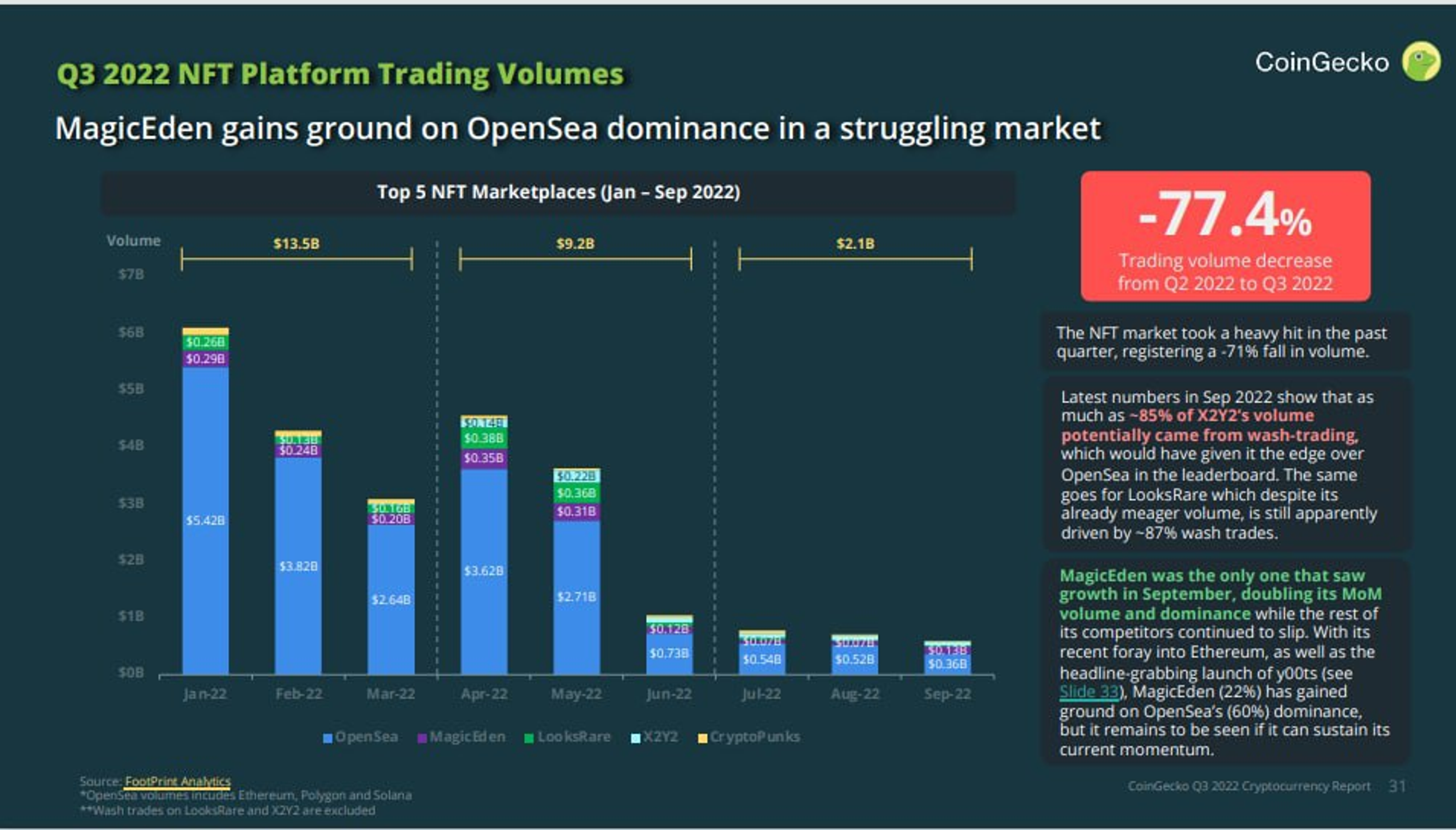

The hype around NFT has slowed down. It seemed like NFT was slated for explosive growth in 2022, being named “word of the year” and coming off a record-high volume in January this year. But as it turns out, that was the peak. Looking at Q3 2022 NFT trading volume around the top 8 chains. There is a 76.4% trading volume decrease from Q2 2022 to Q3 2022.

Since then, the trading volume has tumbled 83% from the start of the year, according to Footprint Analytics’s data on CoinGeco. Recent months have logged numbers lower than July 2021, right before NFT summer. Most notably, Ronin and Avalanche have fallen out of the Top 8, replaced by ImmutableX and Panini. Recent sports mania has spilt over to the NFT space, propelling Flow into the Top 3. Solana’s NFT ecosystem doubled its September volume while all its competitors faltered.

During this period of time, where the market is bearish, you will see changes. For example, in Q3 Magic Eden gains grounds on OpenSea dominance. Magic Eden was the only one that saw growth in September, doublings its month-on-month volume and dominance, while the rest of its competitors continued to slip further. Magic Eden (22%) has gained ground on OpenSea’s (60%) dominance, but it remains to be seen if it can sustain its current momentum.

Another factor in sustaining the current momentum is aligning with the regulatory norms. There is still disagreement over how to handle NFTs, which makes it difficult to set clear regulatory norms. NFTs can now be seen in one of three ways: as commodities, securities, or intellectual property. Let’s explore each interpretation in more detail.

Commodities

Commodities are defined by US law as reasonably interchangeable services, goods, and rights, including money and interest rates, that are traded as commercial articles. The Commodity Futures Trading Commission (CFTC) asserts that cryptocurrencies like Bitcoin and Ethereum, as well as renewable energy credits and other intangible assets, are included in the definition of commodity.

If we take NFTs, they resemble cryptocurrencies in several ways. They may be bought and sold and are based on blockchain technology. In addition, the CFTC emphasises price manipulation and commodities exchanges more than it does on underlying assets and issuers. The Commodity Exchange Act (CEA) may be implemented if it is decided that NFTs should be classified as commodities. The CEA’s rules on manipulative trading may be applicable in this situation.

Securities

Most NFTs with a single owner and only one unique asset are unlikely to be securities. However, under certain situations, they might. If an NFT possesses security-like characteristics or otherwise satisfies the Howey test, such as when money or another kind of compensation is invested with a reasonable expectation that gains will result from others’ efforts, then the NFT may be subject to US securities legislation. A case-by-case Howey analysis is essential to ascertain if a specific NFT is a security. NFTs may, however, violate securities laws in the following situations, depending on the specifics:

- NFTs are pre-sales of digital assets intended to be used on a platform that has not yet been developed, with the sale’s proceeds going toward developing the platform;

- Digital assets can be “pooled” or “fractionalised” (for instance, in the case of art, when creators pool resources and divide profits, or where several NFTs reflect different investors’ fractional ownership of a single asset);

- NFTs are a license to a digital asset (like a song) and a portion of its earnings (e.g., a percentage of sales).

Intellectual Property

NFTs might be covered by intellectual property rights such as copyright, design patents, and trademark protections. As a result, buyers of NFTs should be aware of any associated intellectual property rights. In fact, the license that comes with many or even most NFTs merely allows the NFT buyer to use, copy, and display the NFT.

A clip of renowned basketball star LeBron James’ slam dunk is an excellent illustration. The video was made available as a limited-edition NBA highlight video collector. The NBA collectables are available for purchase and sale on the Top Shot NFTs market. The NBA owns the copyright, nevertheless, and the rules of its licensing agreement continue to apply to any purchased item’s replication.

However, while most NFT producers place limitations on commercial use, other authors grant NFT owners broader rights. Members of the Bored Ape Yacht Club (BAYC) have the right to use their “apes” for commercial purposes, which allows them to produce and market hats, T-shirts, mugs, and other items.

Brand owners should consider how current or upcoming design patents can protect against imitations or infringement in addition to trademark and copyright protection. Because they grant owners full ownership of an infringer’s profits rather than just the fraction related to the use of the design, design patents are important intellectual property protections compared to other IP rights.

Fraud Schemes

Despite being a relatively new idea, NFTs are already being utilised to commit numerous forms of fraud. Here, we go over some of the most prominent NFT-related fraud schemes that have occurred:

- Tokenisation– The process of producing digital tokens that reflect ownership of physical assets is known as tokenisation. This happens when someone steals an artist’s creation without their consent and “mints” it to create an NFT.

- Wash trading– This is the practice of users manipulating transactions by trading with themselves or others to feign large demand for an NFT, manipulate its price, or enhance its visibility.

- Insider trading– The practice of using information that is not generally known to benefit personally from it. In recent high-profile situations, employees and executives of NFT companies and markets have engaged in behaviour that may be viewed as unfair or illegal. Various events generate negative press for these organisations. NFT insider trading regulations frequently forbid buying NFTs based on secret information. Similarly, multiple forms of trading in business NFTs that aim to inappropriately manipulate the perceived price or trading volume of such NFTs are prohibited.

- Anti-Money Laundering– NFTs, especially those with large value, may occasionally be utilised to aid in money laundering. A study on how the art market aids in the financing of terrorism and money laundering was released by the US Department of Treasury. The study covered a variety of topics, including the dangers of financial crimes in relation to digital art and NFTs. The study discovered that the high-value art market has several intrinsic characteristics that could make it susceptible to various financial crimes.

To Conclude

As we can see, the market for NFTs is still growing, and it will take some time until an appropriate regulatory framework for NFTs is put in place. Having said that, governments all over the world have already begun the process of developing NFT norms and standards, proving that they are seriously interested in these digital assets.

Additionally, you should be aware that the phenomenal success of NFTs will undoubtedly result in fraudulent activities. For this reason, it is becoming more and more crucial to conduct your research before purchasing or investing in NFT collections or projects.

Source: https://www.benzinga.com/22/10/29371369/are-non-fungible-tokens-nft-regulated-what-are-the-concerns

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.