There is a lot to learn about what appears to be the first bear market since 2018 in light of recent developments in the cryptocurrency space. For both experienced and novice investors, bear markets have historically been a very trying time, with little to no gains being realized. Many investors suffer significant financial losses during bear markets as they attempt to trade despite the unpredictability of recovering from failures. For a newcomer to succeed in cryptocurrency, learning how to protect your investments and have liquidity for the next bull run is crucial. The aim of this article is to offer informed advice on how to avoid common errors in a bear market and essential steps to take in preparation for the continuation of a bull run in this article.

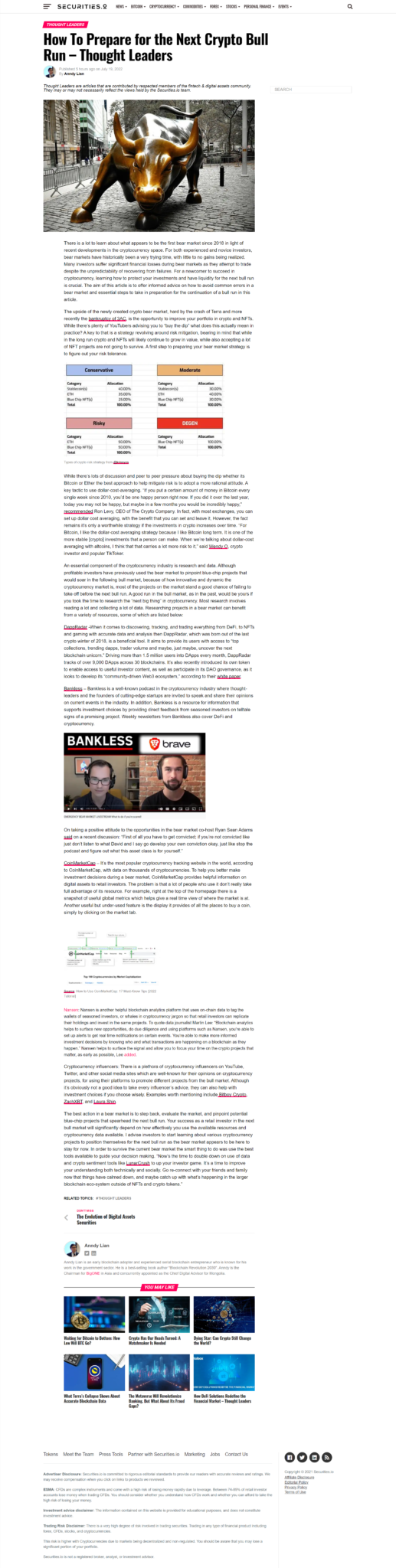

The upside of the newly created crypto bear market, hard by the crash of Terra and more recently the bankruptcy of 3AC, is the opportunity to improve your portfolio in crypto and NFTs. While there’s plenty of YouTubers advising you to “buy the dip” what does this actually mean in practice? A key to that is a strategy revolving around risk mitigation, bearing in mind that while in the long run crypto and NFTs will likely continue to grow in value, while also accepting a lot of NFT projects are not going to survive. A first step to preparing your bear market strategy is to figure out your risk tolerance.

Types of crypto risk strategy from @krissyos

While there’s lots of discussion and peer to peer pressure about buying the dip whether its Bitcoin or Ether the best approach to help mitigate risk is to adopt a more rational attitude. A key tactic to use dollar-cost-averaging. “If you put a certain amount of money in Bitcoin every single week since 2010, you’d be one happy person right now. If you did it over the last year, today you may not be happy, but maybe in a few months you would be incredibly happy,” recommended Ron Levy, CEO of The Crypto Company. In fact, with most exchanges, you can set up dollar cost averaging, with the benefit that you can set and leave it, However, the fact remains it’s only a worthwhile strategy if the investments in crypto increases over time. “For Bitcoin, I like the dollar-cost averaging strategy because I like Bitcoin long term. It is one of the more stable [crypto] investments that a person can make. When we’re talking about dollar-cost averaging with altcoins, I think that that carries a lot more risk to it,” said Wendy O, crypto investor and popular TikToker.

An essential component of the cryptocurrency industry is research and data. Although profitable investors have previously used the bear market to pinpoint blue-chip projects that would soar in the following bull market, because of how innovative and dynamic the cryptocurrency market is, most of the projects on the market stand a good chance of failing to take off before the next bull run. A good run in the bull market, as in the past, would be yours if you took the time to research the “next big thing” in cryptocurrency. Most research involves reading a lot and collecting a lot of data. Researching projects in a bear market can benefit from a variety of resources, some of which are listed below:

DappRadar -When it comes to discovering, tracking, and trading everything from DeFi, to NFTs and gaming with accurate data and analysis then DappRadar, which was born out of the last crypto winter of 2018, is a beneficial tool. It aims to provide its users with access to “top collections, trending dapps, trader volume and maybe, just maybe, uncover the next blockchain unicorn.” Driving more than 1.5 million users into DApps every month, DappRadar tracks of over 9,000 DApps across 30 blockchains. It’s also recently introduced its own token to enable access to useful investor content, as well as participate in its DAO governance, as it looks to develop its “community-driven Web3 ecosystem,” according to their white paper.

Bankless – Bankless is a well-known podcast in the cryptocurrency industry where thought-leaders and the founders of cutting-edge startups are invited to speak and share their opinions on current events in the industry. In addition, Bankless is a resource for information that supports investment choices by providing direct feedback from seasoned investors on telltale signs of a promising project. Weekly newsletters from Bankless also cover DeFi and cryptocurrency.

On taking a positive attitude to the opportunities in the bear market co-host Ryan Sean Adams said on a recent discussion: “First of all you have to get convicted; if you’re not convicted like just don’t listen to what David and I say go develop your own conviction okay, just like stop the podcast and figure out what this asset class is for yourself.”

CoinMarketCap – It’s the most popular cryptocurrency tracking website in the world, according to CoinMarketCap, with data on thousands of cryptocurrencies. To help you better make investment decisions during a bear market, CoinMarketCap provides helpful information on digital assets to retail investors. The problem is that a lot of people who use it don’t really take full advantage of its resource. For example, right at the top of the homepage there is a snapshot of useful global metrics which helps give a real time view of where the market is at. Another useful but under-used feature is the display it provides of all the places to buy a coin, simply by clicking on the market tab.

Source : How to Use CoinMarketCap: 17 Must-Know Tips [2022 Tutorial]

Nansen: Nansen is another helpful blockchain analytics platform that uses on-chain data to tag the wallets of seasoned investors, or whales in cryptocurrency jargon so that retail investors can replicate their holdings and invest in the same projects. To quote data journalist Martin Lee: “Blockchain analytics helps to surface new opportunities, do due diligence and using platforms such as Nansen, you’re able to set up alerts to get real time notifications on certain events. You’re able to make more informed investment decisions by knowing who and what transactions are happening on a blockchain as they happen.” Nansen helps to surface the signal and allow you to focus your time on the crypto projects that matter, as early as possible, Lee added.

Cryptocurrency influencers: There is a plethora of cryptocurrency influencers on YouTube, Twitter, and other social media sites which are well-known for their opinions on cryptocurrency projects, for using their platforms to promote different projects from the bull market. Although it’s obviously not a good idea to take every influencer’s advice, they can also help with investment choices if you choose wisely. Examples worth mentioning include Bitboy Crypto, ZachXBT, and Laura Shin.

The best action in a bear market is to step back, evaluate the market, and pinpoint potential blue-chip projects that spearhead the next bull run. Your success as a retail investor in the next bull market will significantly depend on how effectively you use the available resources and cryptocurrency data available. I advise investors to start learning about various cryptocurrency projects to position themselves for the next bull run as the bear market appears to be here to stay for now. In order to survive the current bear market the smart thing to do was use the best tools available to guide your decision making. “Now’s the time to double down on use of data and crypto sentiment tools like LunarCrush to up your investor game. It’s a time to improve your understanding both technically and socially. Go re-connect with your friends and family now that things have calmed down, and maybe catch up with what’s happening in the larger blockchain eco-system outside of NFTs and crypto tokens.”

Original Source: https://www.securities.io/how-to-prepare-for-the-next-crypto-bull-run-thought-leaders/

Anndy Lian is an early blockchain adopter and experienced serial entrepreneur who is known for his work in the government sector. He is a best selling book author- “NFT: From Zero to Hero” and “Blockchain Revolution 2030”.

Currently, he is appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. Prior to his current appointments, he was the Chairman of BigONE Exchange, a global top 30 ranked crypto spot exchange and was also the Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. Lian played a pivotal role as the Blockchain Advisor for Asian Productivity Organisation (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region.

An avid supporter of incubating start-ups, Anndy has also been a private investor for the past eight years. With a growth investment mindset, Anndy strategically demonstrates this in the companies he chooses to be involved with. He believes that what he is doing through blockchain technology currently will revolutionise and redefine traditional businesses. He also believes that the blockchain industry has to be “redecentralised”.